SPX

Friday April 12, 2013

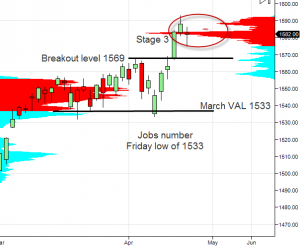

This week has been one for the history books as the market headed to new all time highs for the SPX, DJI. One week later after a train wreck unemployment report, we have gone from ES 1533 to 1593 in 5 days. The expectations were for a 160- 200k number, it came in at 88k. The market moved down to unfair lows of a balanced area and then continued to go vertical into the following Thursday.

The question now is where do we go from here? To far to fast? Rest and continue higher? Or is this the blow off top before we get a ten percent correction? For us intra day traders we will be more sensitive of buying these new highs. We clearly have a stage 3 forming after Thursdays Stage 2 came into play. The level of the break out is right back to 1569 on the ES. Thursday trading action found responsive sellers as the cash SPX came within stricking distance of 1600.

When you look at how far we have come since January it truly is amazing on bad data, euro issues, uncertainty in the economy. The Fed continues QE with the printing presses running with commitments to not change any of that until unemployment drops below 6.5%. This real life examples of the market being a forward looking mechanism, believing that all is well or will be. Keep your power dry and watch for signs of distribution over the next few weeks as we draw closer to sell in May and go away time frame.