Weekly Review of ES

The beginning of this week felt more like the sell in May and go away factor than last week of June. The market came down to significant area of support and actually found buyers looking for value in the 1550-1540 area. It’s not a surprise that we have bounced from undervalued conditions. The calendar is showing us that it is end of month which typically can create a positive bias to the market.

We have been seeing some really nice test of key levels in the Asian and European sessions. If one had the ability to stay awake 24 hours you would find that the overnight is much more favorable than the US when all the machines turn on.That is another topic for a later time.

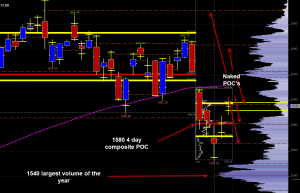

So the last couple days bounce is pushing us back to levels that should find sellers stepping back in to give us another push back down and retest the recent lows. If you notice the chart shows the 5 day composite POC at 1580 which is also Tuesdays POC. Mondays POC is also open at 1566. Remember that the daily is in stage 3 and as we approach the unfair highs we can look for this market to find supply and move back toward 1580 and then 1566. These naked POC’s which are high volume areas, have not been tested and hence the term naked or untouched POC’s. These will act as great target objectives on days when the market is moving back toward that direction. If you look the orange dash line at 1644- that is a naked POC which some point will be closed.

With two more days left in June I’m looking for some rotation in here and get a close back around 1580 by Friday. Our swing long position Monday from 1557 got fill yesterday toward the close at 1586 and today we saw some continuation after a really nice test overnight of the 1575 level. Stay focused on the daily structure as that will lend to keeping you on the right side of the market intraday.

Happy profiling